‘Now is not the time to make a major purchase’, Angus Reid

Posted August 1, 2022 7:11 pm.

Three-quarters of Canadians think “now is not the time to make a major purchase” as inflation hits a record high, making them shift their budgeting focus on groceries and gas, according to new data from Angus Reid.

The inflation rate in June reached its highest in 10 decades, 8.1 per cent, which means the Bank of Canada (BofC) has to take action to “correct course.”

Inflation increases the cost of living and makes everything more expensive. Consequently, people would focus more on the essentials and avoid buying a house, a car, a vacation, or even big renovations.

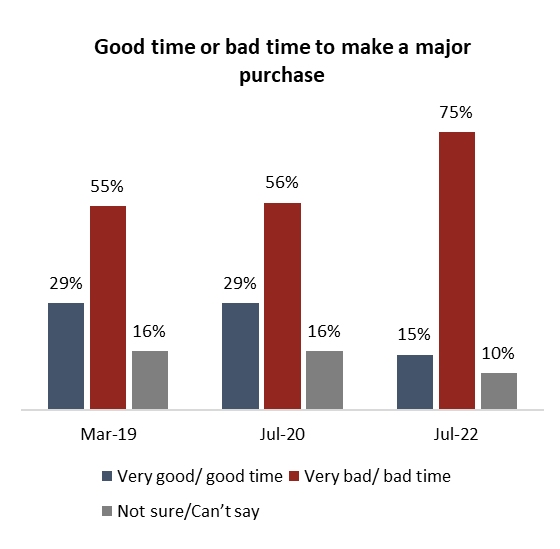

This year, 75 per cent of Canadians say it’s a very bad time to buy, 15 per cent say it’s a good time to buy, and 10 per cent are not sure.

The percentage of people who say it’s a bad time to buy has significantly increased since last year, when 56 per cent of people said it’s a very bad time to buy.

A picture of a graph showing the percentage of Canadians who think it’s a bad time to make a big purchase (Courtesy: Angus Reid)

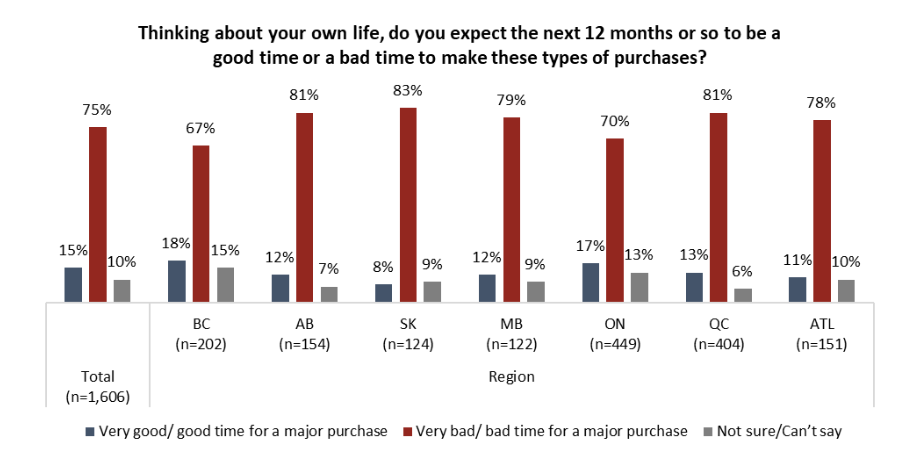

People in British Colombia are the most optimistic about the next 12 months to make big purchases, with 18 per cent saying it’s a good time to buy. Ontarians are also optimistic with 17 per cent agreeing.

On the other hand, people in Alberta (12 per cent), Saskatchewan (8 per cent), Manitoba (12 per cent), Quebec (13 per cent), and Atlantic Canada (11 per cent), are less optimistic.

A graph showing if Canadians think the next 12 months are a good time to buy, by region (Courtesy: Angus Reid)

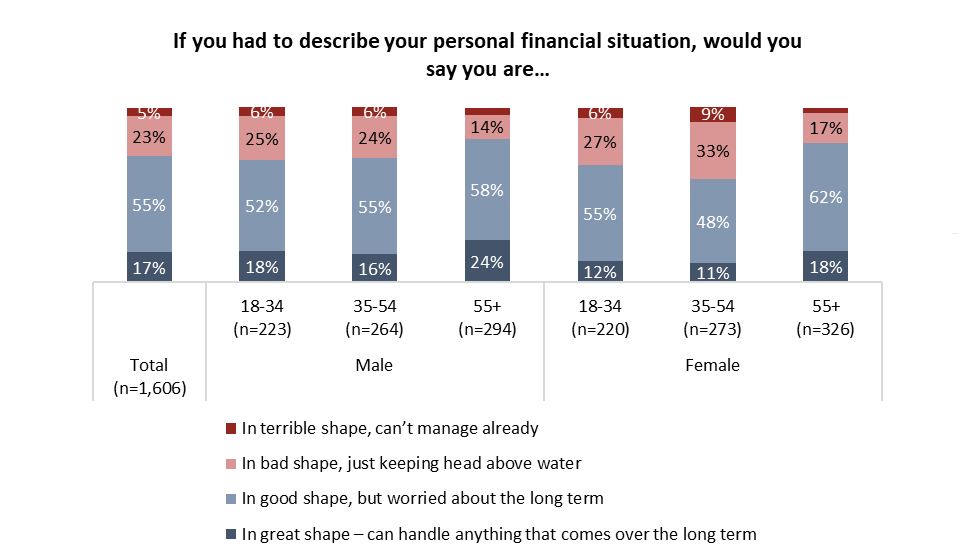

Angus Reid suggests there is a significant minority of Canadians in dire financial situations, where 28 per cent are barely able to make ends meet — the rate has increased 10 points since July 2020.

Fewer than 17 per cent say they are in great shape with no concern of the future, while 55 per cent would say they are good financially. However, they are still financially worried for the long term.

The data also suggests younger Canadians are more likely to be in bad financial situations, where at least three-in-ten Canadians under 54 are in bad financial situations.

Nine per cent of females between 35-54, are in terrible financial situation, while only six per cent of men within the same age group are in terrible financial situation.

On the other hand, one-quarter (24 per cent) of men over the age of 54 are doing great with no worries about their financial future.

A picture of a graph showing a description of Canadian’s financial situation (Courtesy: Angus Reid)

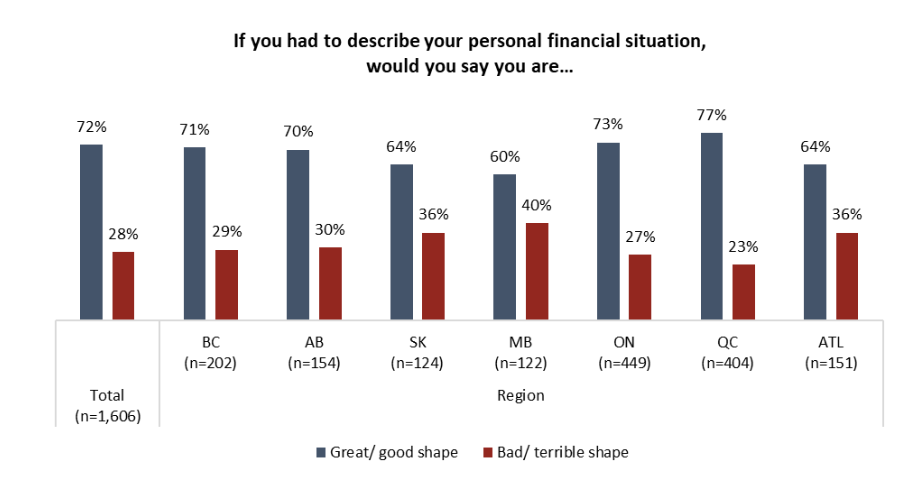

Manitoba leads the numbers of Canadians — Two-in-five (40 per cent) — in being in bad financial state. The same case for Saskatchewan and Atlantic Canada with 36 percent. People in Quebec are the wealthiest in the country with more than three-quarters (77 per cent).

A picture of a graph showing Canadian’s financial situation by region (Courtesy: Angus Reid)

READ MORE:

-

Economists predict inflation hit 8% in June amid ‘reopening effect’

-

‘Tough’ 6-12 months ahead for Canadians amid inflation, rate hikes: expert

-

Grocery hacks: Dietitian weighs in as people face tight budgets, rising inflation

‘All eyes on Bank of Canada’

Inflation is related to global issues, such as supply chain, and the war in Ukraine affecting food and gas supplies, raising those prices globally. However, in Canada, the BofC can control inflation by increasing the interest rate. So, it has raised its key interest rate from 0.25 per cent to 2.5 per cent putting “all eyes on Bank of Canada” to fight inflation.

Seventy-one percent of Canadians say they are closely watching the BofC’s attempt to stop inflation, 24 per cent are watching but not closely, and 5 per cent are not watching.