Police warn Manitobans about Interac e-transfer scam

Posted April 10, 2024 12:48 pm.

Last Updated April 10, 2024 9:11 pm.

An Interac e-transfer scam is becoming increasingly prevalent in Manitoba, police are warning.

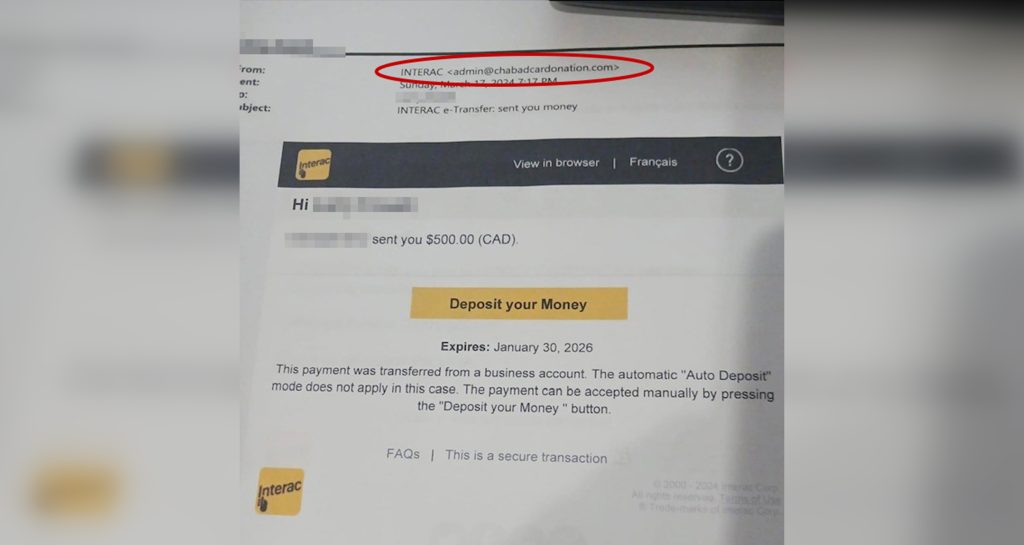

Manitoba RCMP say victims are receiving an email that appears to be a legitimate Interac e-transfer.

When the victim clicks on the link and enters their banking information, it gives the scammers access to the bank account, police say.

Cybersecurity expert Hernan Popper says most scams have one thing in common: to convince you to give up your information through any means necessary.

“It started maybe a hundred years ago with letters in the mail, and it continued with the evolution of technology through different methods,” said Hernan Popper, the founder and principal consultant of Popp3r — a business working with organizations to help them minimize risks.

Popper says those most at risk are people who haven’t been exposed to technology, like elderly people and young children.

“It’s very easy to deploy these scams,” he said. “When you’re doing e-transfer scams or any similar scams, you can do it over e-mail. You can do it over SMS … any kind of communication method.

“All these attacks are automated and they are being done at a massive scale.”

Popper believes these types of scams are happening thousands of times each day.

“There is no barrier of entry for criminals to actually attempt theses attacks,” he said.

“It’s trivial to actually spoof a bank’s email address or an organization’s or credit union’s email address. Technology has become so powerful.”

More than one scam

Laura Hawkins, owner of Enigma Escapes, says she fell victim to a similar scam. Cybercriminals used her Facebook login to gain access to her business, and in turn got access to thousands more people they could scam.

“What happened was, they started to communicate with people who were checking with us,” Hawkins explained.

“I felt violated. I felt sick. I felt like I was out of control.”

Hawkins was travelling in the United States when she realized she couldn’t get into the Enigma Escapes Facebook page, then realized she couldn’t get into her own Facebook page.

She called Popper, who investigated and concluded her personal Facebook profile credentials were compromised and scammers gained access to her business’ Facebook page.

“The more information (that’s) out there for the public to be aware of those (scams), more awareness we’re going to (have) about these situations … more chance we have when this happens to us, to actually not fall for the scam,” Popper said.

‘Is this real? Is this legit?

In the case of money e-transfers, police advise anyone not expecting one to be cautious, check the email carefully, and not click links when in doubt.

Setting up e-transfer auto-deposit is another way to avoid fraudulent transfers, Mounties say.

Victims of fraud are asked to contact their local police.

Popper says when it comes to e-transfer scams, often banks have the consumer protected — but this is not always the case.

Popper highly recommends setting up two-factor authorization for all accounts.

“Simply slowing down and taking the time to say, ‘is this real? Is this legit? Could this be a scam’ will be the biggest way of protecting yourself,” Popper told CityNews.

“People trust people. And the trust factor is what’s compromised and what actually creates that risk.”

Hawkins says she now changes her passwords regularly. “I change them, I would say, probably every few months, and I didn’t before,” she said.