Personal use of work smartphone may become more of a tax headache for employers

Posted October 10, 2019 12:17 pm.

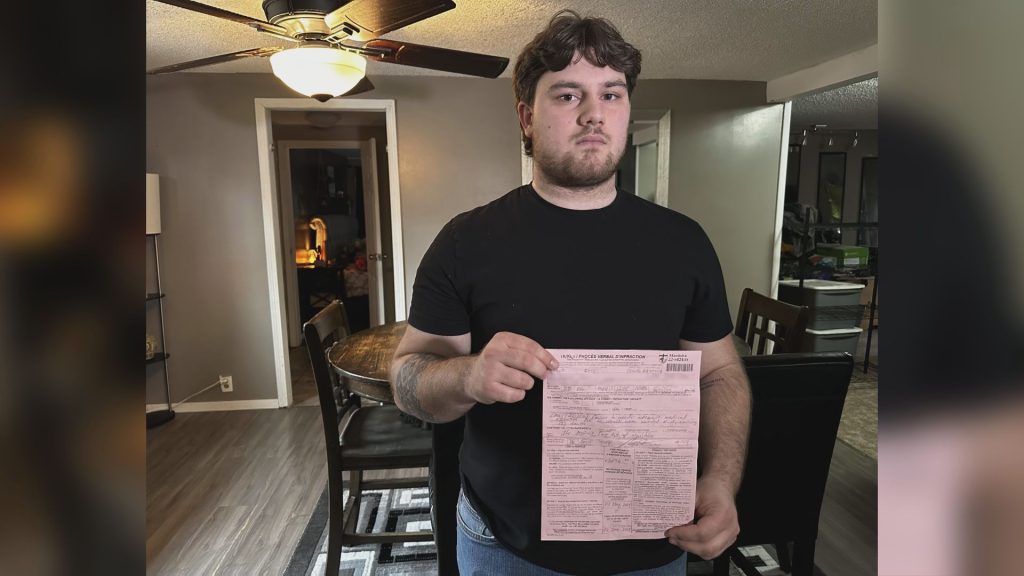

TORONTO — The use of a company-supplied smartphone, laptop or other electronic device is commonplace these days, and employers know full well that employees will use them both for work and personal purposes.

However, new guidelines from Canada Revenue Agency suggest employers may have to take a fresh look at how much of the cost of these devices can be attributed to their commercial activities.

“Tax authorities around the world have recognized that the vast majority of usage of a cellphone these days is personal,” says Thom Damstra, Toronto-based founder and chief executive of data analytics firm MobilityView.

While there’s a potential for use of company-supplied phones to be considered a “personal taxable benefit” several tax experts say that’s not new and the tax rules give employers ways to minimize the impact on their employees.

But Damstra expects companies will soon have to provide more documentation to the Canada Revenue Agency if they want to get credits to reduce the the goods and services taxes that the business has to pay itself.

He expects companies will soon have to provide more documentation to the Canada Revenue Agency if they want to get credit for the commercial usage of mobile devices and services provided to employees.

He points to CRA guidelines issued in April that say companies may have to demonstrate that at least 10 per cent of a mobile phone’s usage is for commercial purposes to qualify for the GST/HST credits.

Even above the 10 per cent threshold, the CRA says tax credits must be proportionate to commercial usage.

In other words, if a company claims that 50 per cent of a mobile phone’s usage is for commercial purposes — it may have to prove that claim if challenged by a CRA auditor.

Bill MacQueen, leader of the indirect tax practice at RSM Canada LLP (formerly Collins Barrow), says he hasn’t noticed any new CRA scrutiny specifically on mobile phones, as Damstra anticipates.

But RSM has noticed that CRA audit teams have become much more zealous with business clients over the past 18 to 24 months.

“Their audit activities have increased quite a bit in frequency and they are becoming much more aggressive in their techniques,” MacQueen says.

RSM Canada warned clients in September that CRA’s auditors have been assuming all taxable supplies — which would include mobile phones — are subject to the maximum GST/HST rate (15 per cent).

RSM said CRA auditors have also been denying all claims for input tax credits, which can reduce how much GST or HST a company pays on supplies, unless there’s sufficient documentation about commercial activity.

“When you use actual numbers, and reduce your tax owed by your input tax credits, it usually is reduced quite a bit,” MacQueen says. “It’s just a matter of providing the documentation that the CRA wants.”

Emily Nielsen, founder and president of Nielsen IT Consulting Inc. in London, Ont., says she doesn’t think her clients have an easy way to distinguish between personal and commercial phone usage.

“These are companies that have hundreds of devices and it’s really difficult to manage,” Nielsen says.

In that context, Nielsen says, it might be less costly in some cases to pay a higher tax rate demanded by CRA than to track the personal and commercial usage of their mobile phones.

“I think it’s the CRA adding a lot more layers of bureaucracy to something that’s already complex.”

MacQueen says there are several factors that explain the CRA’s more aggressive stance towards indirect taxation, which includes the federal goods and services tax (GST) and the harmonized sales tax (HST) charged in some provinces.

For one thing, he says, recent federal budgets have increased how much money the CRA has to spend on audits.

As a result, the CRA has hired hundreds of auditors with up-to-date technical skills.

“They’re very well-versed in technology, and data-mining capabilities,” MacQueen says.

A CRA spokesperson told The Canadian Press that despite the recent guidelines, “the non-compliance of reporting on the use of cellular phones by employers when necessary is considered an area of low-risk” for the agency.

This report by The Canadian Press was first published Oct. 10, 2019.

David Paddon, The Canadian Press